Capital investment decisions

Data: 2.03.2018 / Rating: 4.7 / Views: 964Gallery of Video:

Gallery of Images:

Capital investment decisions

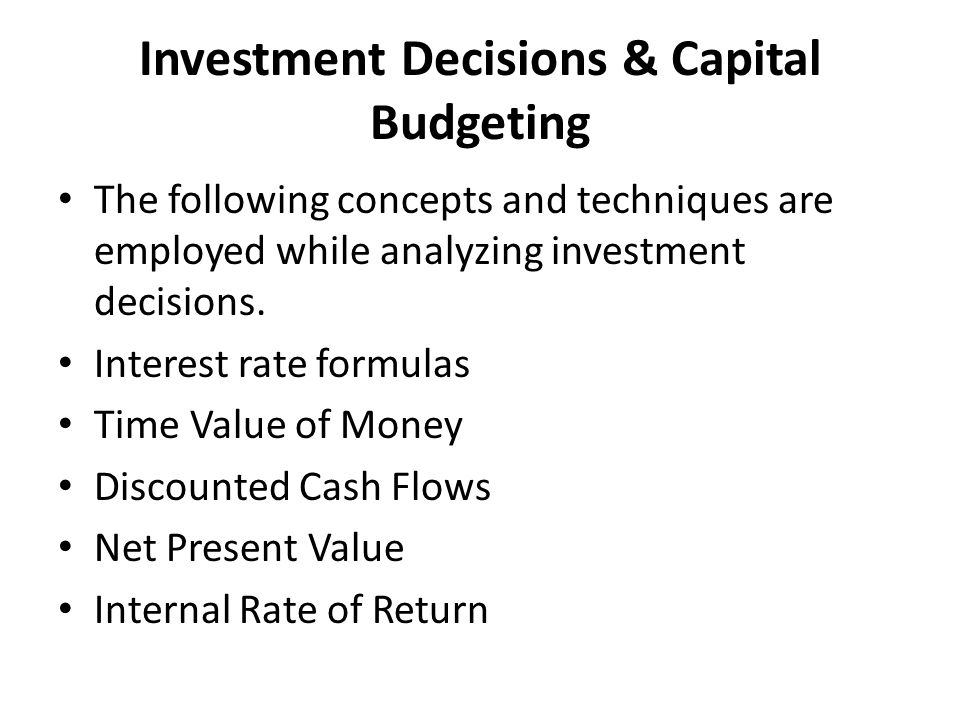

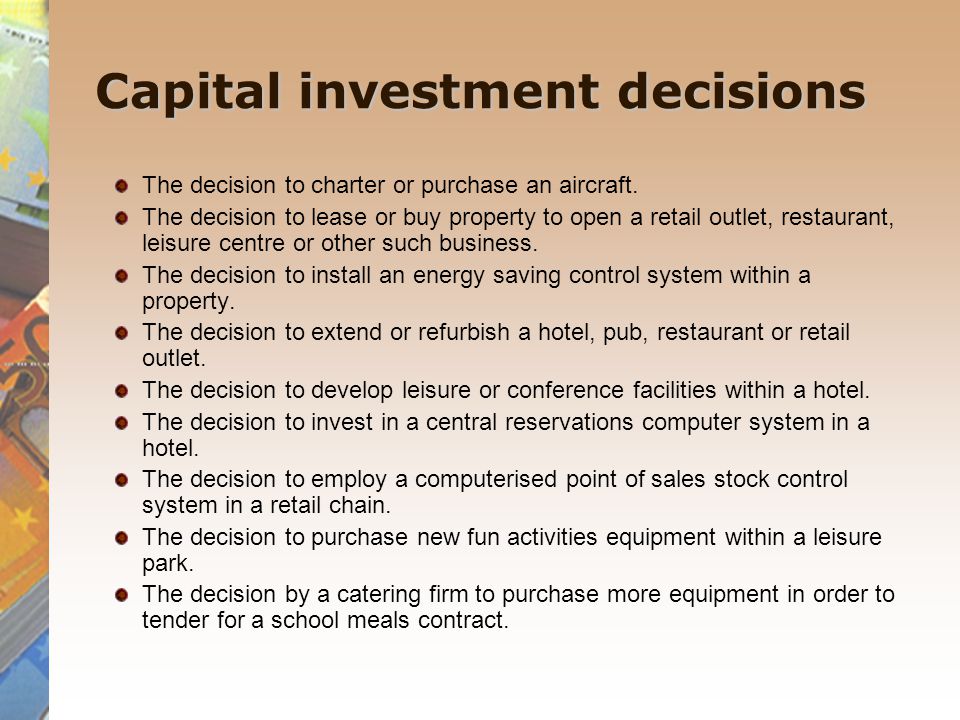

REAL OPTIONS IN CAPITAL INVESTMENT DECISIONS Strategic NPV Passive NPV Present value of options arising from Capital Investment Decisions. Capital investment decisions also can be called capital budgeting in financial terms. Capital investment decisions aim includes allotting the capital investment funds of the firm in the most effective manner to make sure that the returns are the best possible returns. Assessing projects as well as the allocation of the capital depends on the project. The capital investment decisions can also be termed as capital budgeting in finance. The purpose of the capital investment decisions includes allocation of the firms capital funds most effectively in order to ensure the best return possible. Capital budgeting is extremely important to firms since capital investment projects make up some of their most important financial investments. These projects often involve large amounts of money and making poor capital investment decisions can have a disastrous effect on the business. Cost of Capital, Investment Decisions and Economic Growth: Implications for Tax Reform I. Introduction Capital investment is a fundamental driver of economic growth through both macroeconomic and microeconomic channels. The positive macroeconomic results occur Also, the capital investment decisions are irreversible in nature, i. once a permanent asset is purchased its disposal shall incur losses. 3) Long run in the business: Capital budgeting reduces the costs as well as brings changes in the profitability of the company. VM577P: Capital Management and Investment Decisions. Ownership Costs, Capital Budgeting and Investing (the Cliffs Notes Version) Draft. JM Gay DVM PhD DACVPM 1215 CAPITAL INVESTMENT DECISIONS Assignment and Online Homework and Project Help CAPITAL INVESTMENT DECISIONS Term paper for One of the greatest challenges managers face is making capital investment decisions. The term capital investment refers broadly to large expenditures made We recently talked with Peter Southard, Ph. , an assistant professor of operations and supply chain management, about his research on capital investment decisions in health care. Q: Why did you decide to examine capital investment decisions in health care? A: Increasing competition and artificiallyimposed price controls in health care are forcing caregivers to rethink how they manage their. The term capital investment has two usages in business. First, capital investment refers to money used by a business to purchase fixed assets, such as land, machinery, or buildings. Secondly, capital investment refers to money invested in a business with the understanding that the money will be used to purchase fixed assets, rather than used to cover the business's daytoday operating expenses. Test and improve your knowledge of Capital Investment Decisions with fun multiple choice exams you can take online with Study. com View Essay Capital Investments paper from BUSINESS A HCS385 at University of Phoenix. Capital Investment Decisions 1 Capital Investment Decisions Katrice Brooks, Samantha Coe, Latoya Bradford. The capital investment decision combines many aspects of accounting and finance. A number of business factors combine to make business investment perhaps the most important financial management decision. Further, all departments of a firmproduction, marketing, logistics, and soonare vitally affected by the investment decisions; so all executives, no matter what their. Discusses which cash flows should be considered in capital budgeting analyses, constructing NPV spread sheets (see additional videos), equivalent (effective) Capital Investment Decisions (Project Appraisal) Capital investment decisions are those decisions that involve current outlays (costs) in return for a stream This video is part of a series of lectures that comprise an MBA level course in Corporate Finance. The lectures build on concepts and principals developed in Capital investment appraisal or capital budgeting is primarily a planning process which facilitates the determination of the concerned firm's investments, both long term and short term. Capital budgeting is also concerned with the setting of criteria about which projects should receive investment funding to increase the value of the firm, and whether to. The DCF model assumes a static environment where all capital investment decisions are reversible without penaltyan assumption that may not hold in a competitive environment. Real options analysis has been proposed as a means of addressing this limitation of the DCF model. Capital investment decisions are concerned with the process of planning, setting goals and priorities, arranging financing, and using certain criteria to select longterm assets. Capital investment decisions involve the judgments made by a management team in regard to how funds will be spent to procure capital assets. There are a number of factors that management must consider when making capital investment decisions, such as: How well an investment fits into the longte One of the most important aspects of a manager's job is to evaluate the feasibility of new initiatives and to make sound investment decisions. This includes conducting a thorough and reliable analysis using the appropriate financial decisionmaking tools. In this course, participants will learn six. Financial management is more than procurement of funds. What do you think are the responsibilities of a finance manager. The Options Approach to Capital Investment. of the conventional approaches to decision making about investment and to present a better framework for thinking about capital investment decisions. Of all the decisions that business executives must make, none is more challengingand none has received more attentionthan choosing among alternative capital investment opportunities. Capital budgeting is vital in marketing decisions. Decisions on investment, which take time to mature, have to be based on the returns which that investment will make. Unless the project is for social reasons only, if the investment is unprofitable in the long run, it is unwise to invest in it now. capital investment decisions concerned with the process of planning, setting goals and priorites, arranging financing and using certain criteria to select long term assets a sound capital investment will earn back its original capital over its life and at the same time provide a reasonable return on investment What Is the Difference Between Capital Investment Decisions and Working Capital Management? by Victoria Duff; Updated April 19, 2017 Corporations are faced with two main tasks: to maintain daily operations and to grow the enterprise by acquiring facilities, equipment, intellectual property. The Dividend Discount Model is followed to calculate the effect that the new investment will have to the companys share. In the section of Conclusions, there is. Qualitative Factors in Capital Investment Decisions; Capital investment is often an equity position that seeks to provide the funds for the longterm growth strategies, not to sustain the. The literature on capital investment and financing decisions for hospitals has suggested several approaches to analyzing sets of options. In this paper, I present a taxonomy of the different approaches; analyze and compare the different elements of the taxonomy; and illustrate and discuss the. Capital investment decisions that involve the purchase of items such as land, machinery, buildings, or equipment are among the most important decisions undertaken by the Chapter 6: Making capital investment decisions Corporate Finance Ross, Westerfield, and Jaffe Outline 1. Relevantincremental cash flows 2. Factors influencing investment decision. Capital investment decisions are not governed by one or two factors, because the investment problem is not simply one of replacing old equipment by a new one, but is concerned with replacing an existing process in a system with another process which makes the entire system more effective. Learn about the importance of capital structure when making investment decisions, and how Target's capital structure compares against the rest of the industry. Financial Advisor Capital investment refers to funds invested in a firm or enterprise for the purpose of furthering its business objectives. Capital investment may also refer to a firm's acquisition of capital. Given recent market events, you may be wondering whether you should make changes to your investment portfolio. The SECs Office of Investor Education and Advocacy is concerned that some investors, including bargain hunters and mattress stuffers, are making rapid investment decisions without considering their longterm financial goals. Capital budgeting from meaning to features to Decisions All in one Place. Capital is the total investment of the company and budgeting is the art of building budgets. Mutually exclusive investment decisions gain importance when more than one proposal is acceptable under the accept reject decision. Consider these ten things when you're using the NPV, IRR, or payback method to make a capital budgeting or investment decision. Remember that the reason you're making a capital budgeting decision is to create more value in the future than exists today. Capital investment decisions are the responsibility of managers of investment centers (see Chapter 12). The analysis of capital investment decisions is a major topic in corporate finance courses, so we do not discuss these issues and methods here in any detail. However, because cost accountants are involved in the development of perfor The possibility that errors in projected cash flows will lead to incorrect decisions. Think of: GM buying Hummer, Warner letting AOL buy it, B of A buying Countywide Sensitivity of. Definition of investment decision: A determination made by directors andor management as to how, when, where and how much capital will be spent on investment opportunities. The decision often follows research to determine costs and. Qualitative Factors in Capital Investment Decisions by Brian Hill; Updated April 19, 2017 A companys capital investments are expenditures made with the expectation they will result in longterm benefits improved efficiency or productivity, cost savings and increased revenues. Capital budgeting decisions relate to decisions on whether or not a client should invest in a longterm project, capital facilities andor capital equipmentmachinery. Capital budget decisions have a major effect on a firms operations for years to come, and the smaller a firm is, the greater the potential impact, since the investment being. Capital investment decisions are highly significant due to number of reasons, some of them are: (a) Investment Linked with Objectives: An enterprise with an objective of survival and growth, incurs capital expenditure every year and takes investment decisions e. , investment in fixed assets and inventory. Need and Importance of Capital budgeting decisions Capital budgeting decisions are of paramount importance in financial decision. The profitability of a business concern depends upon the level of investment made for long period. Capital investment decisions are not transparent and allow opportunities for all sorts of abuses: from un necessary pet projects promoted by local politicians Making better decisions about the risks of capital projects By Martin Pergler and Anders Rasmussen. Making better decisions about the risks of capital projects. Share this article on LinkedIn; Never is the fear factor higher for managers than when they are making strategic investment decisions on multibilliondollar capital. However, managers today must consider a range of qualitative factors when making capital investment decisions. Ethics, safety, company culture and environmental concerns can affect the decision to

Related Images:

- The hobbit an unexpected journey dub

- Monsters of meat

- 3 pig and a baby

- Game motogp 13

- The one of other man

- Joe cocker gold

- James taylor james taylor

- House md english subtitles

- Zeze di camargo luciano

- The dark knight special

- Walking dead s05e01 ita

- Trey songz 2010

- Jailhouse rock movie

- Emma stoned teenfidelity

- House Rules AU S01E02

- Sword art online horriblesubs 480p

- Atreyu congregation of the damned

- Ipsw iphone 2g 312

- The return of the king theatrical

- Tears of April 2008

- Nip tuck s07e05

- Tengen toppa gurren lagann vostfr

- Marple a pocket full of rye

- The 100 fee

- Slut puppies 8 new 2014 jules jordan video dvdrip

- Bull run fever

- Anna karenina sub

- French entretien avec un vampire

- The one percent 2006

- Rescue me season 3 dvd

- Star wars 3 revenge of the sith dvd

- Oxford english android

- Finding true love discovery of love

- Ambush in waco

- ALLEN LANDE

- Orange is the new black S2

- Metal Gear Solid 4 Guns of the Patriots

- Collide laidback luke

- Wind boot usb

- The walking dead s01 esp

- Antoine antoinette 1947

- Csi miami season 8

- Phat girl black

- Pc screen saver

- Wanted nordic dvd

- Spiderman evil that men do

- French king speech

- Heroes of the might and magic III

- Top gear worst car in the history of the world

- Hot new 2011

- Swiftkey 4 android

- F1 2013 720p

- MacX Video Converter Pro 5

- I hate luv storys brrip

- Stuart A Life Backwards

- Vista premium dell

- Der the dome 720p

- A vida ate parece uma festa

- Pc game borderlands

- The heart collector

- Jay z metallica

- Dvd wreck it ralph

- Off the leash

- The old album

- Window xp sp2 serial

- Subway surfer android

- Charmed season 4

- A team brrip

- The ion king

- Beautiful to lie

- Lil jon part

- Anjunabeats vol 7

- L orient express